Paying for the care of children or adult dependents is one of the largest monthly expenses many families face. Fortunately, the IRS provides a tax credit of up to 50% of expenses that any taxpayer with children and adult dependents can claim, helping to offset these significant costs.

What Is the Child and Dependent Care Credit Amount?

For the tax year 2025, the Child and Dependent Care Credit ranges from 20% to 35% of allowable expenses.

The total expenses you can use to calculate the credit are capped at:

-

$3,000 for one qualifying dependent.

-

$6,000 for two or more qualifying dependents.

Income Thresholds (AGI)

The percentage of expenses you can claim depends on your Adjusted Gross Income (AGI):

-

Maximum Rate (35%): Applies to taxpayers with an AGI of up to $15,000.

-

Phase-out: The percentage gradually decreases as income grows.

-

Minimum Rate (20%): Applies to taxpayers with an AGI of $43,000 and above.

Regardless of income level, a taxpayer can claim the credit at the 20% rate if all other requirements are met.

How to Obtain the Child and Dependent Care Credit

You can receive the Child and Dependent Care Credit even if your employer pays or subsidizes care expenses. However, the dependent generally must meet specific strict requirements regarding age and capability.

Age and Capability Requirements

-

Children Under 13: Your child must be no older than 13 years if you’re claiming the child care credit.

-

Dependents Incapable of Self-Care: You also have the right to claim coverage of care expenses for children and dependents aged 13 or older if they are physically or mentally incapable of self-care.

Definition of “Incapable of Self-Care”

The IRS defines those who cannot physically or mentally care for themselves as:

-

Individuals who cannot dress, bathe, or eat due to physical or mental problems.

-

Individuals who require constant attention because it’s dangerous for them to remain unsupervised.

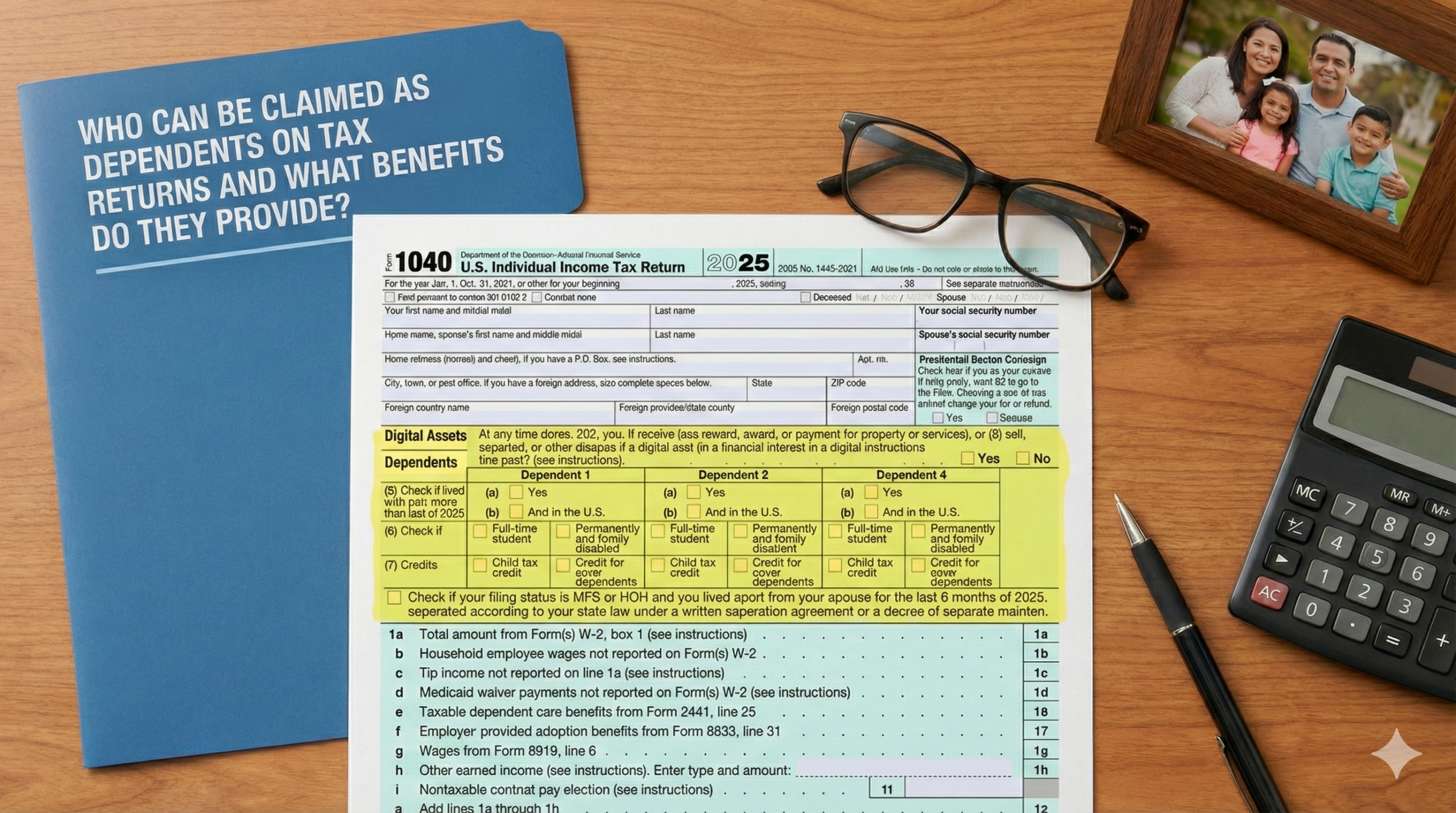

You have the right to claim these adult dependents if they lived with you for more than six months and meet the criteria above.

Special Filing Situations

Married but Living Separately

If you are married but living separately from your spouse, you can still claim reimbursement for care expenses provided that:

-

The child or adult lived with you for at least six months.

-

You paid more than half the costs of maintaining your household.

Divorced or Separated Parents

Divorced parents or those living separately sometimes allow the non-custodial parent to claim their child as a dependent on their tax return.

However, for the Child and Dependent Care Credit, the rules are slightly different:

-

The Custodial Parent Rule: You can claim the credit even if you don’t claim the child as a dependent on your return, provided the child lived with you during the year longer than with the non-custodial parent.

-

Expense Requirement: You must have effectively paid for their care to enable you to work or look for work.

How Gennadiy Arnautov CPA Can Help

Tax credits for children and dependents can significantly reduce your tax liability or increase refunds, but the rules for their application have many nuances.

Our specialists will help:

-

Determine eligibility: Verify if your children or dependents meet specific IRS requirements.

-

Maximize credits: Correctly apply the Child Tax Credit and Credit for Other Dependents.

-

Ensure compliance: Properly complete necessary forms and supporting documents.

-

Prevent delays: Avoid errors that can lead to denial of the credit or refund delays.

Don’t lose your right to family tax benefits! Competent use of tax credits for children and dependents will help keep more funds in your family budget.

Contact Gennadiy Arnautov CPA today for professional consultation and maximum tax benefit.